Secure Your Rent, Unlock Your Future

Save consistently, unlock rent support, and move closer to your dreams—one deposit at a time.

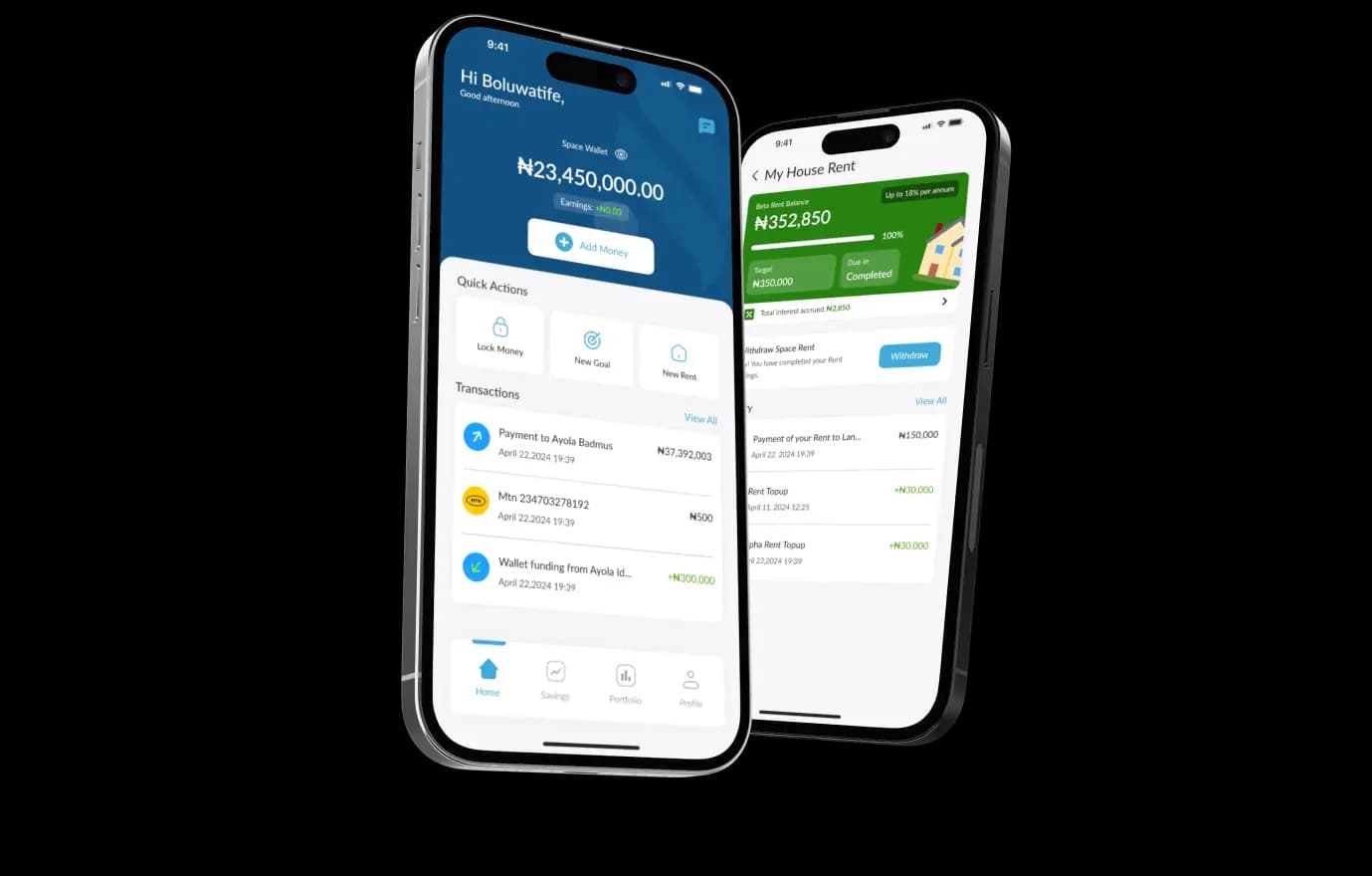

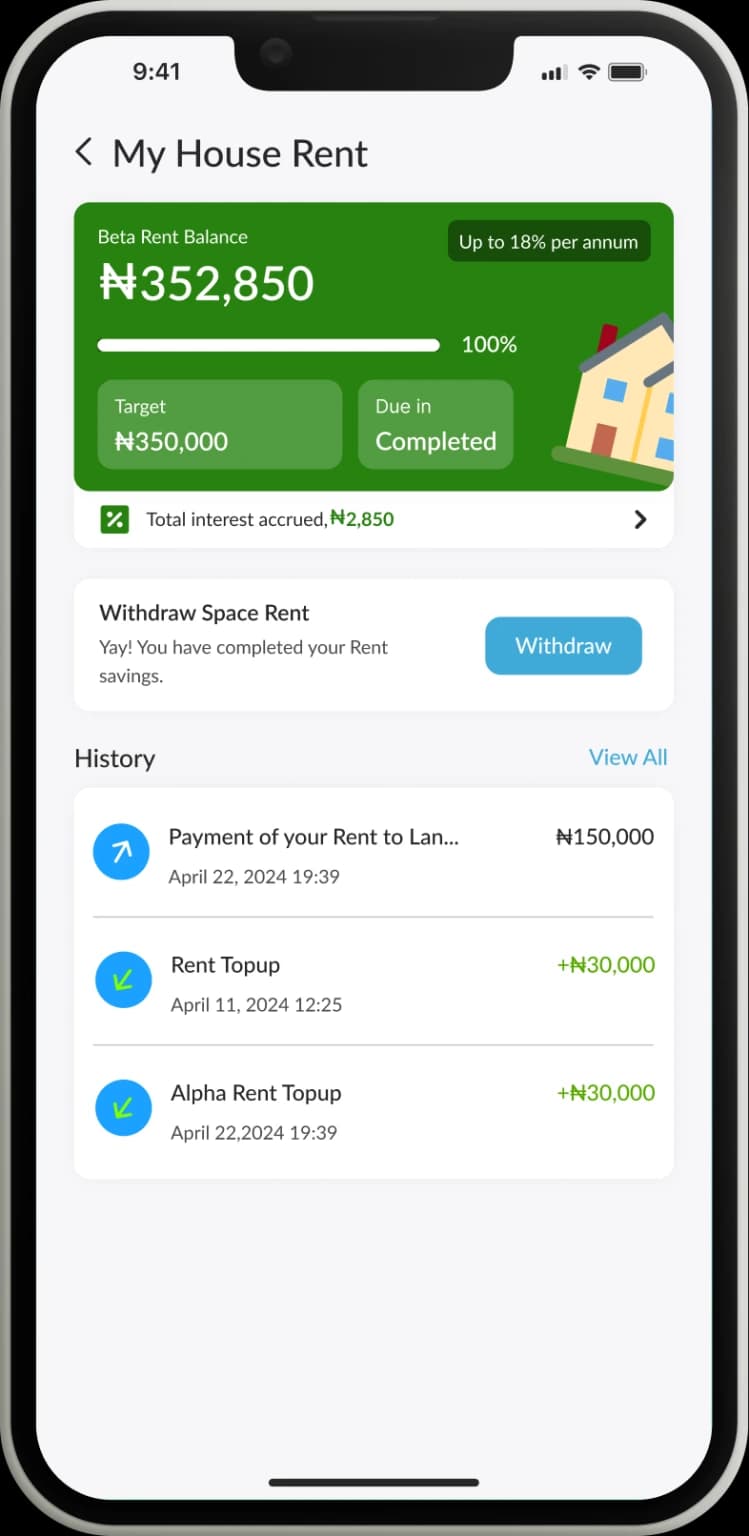

The Core Of It All: SpaceRent

Say goodbye to rent stress. Save towards your rent in small bits. When you hit 70%, we step in to support you with 30%.

🔐 Landlord gets full payment.

🎁 Unlock new rewards and features after each successful cycle.

How It Works

Create a plan

Set your rent amount and savings schedule.

Save weekly , bi-weekly or monthly

Stay consistent and track your progress.

Hit 70%? We Top Up 30%

We disburse 100% directly to your landlord.

Unlock New Features

Each completed cycle opens doors to flexible savings and even car ownership.

Join Thousands Taking Control of Their Rent

Stop the cycle of rent panic. Start saving smart. Unlock rewards.

Before RentSpace, I used to borrow to pay rent. Now, I save little by little and sleep in peace.

I plan everything—except my rent. RentSpace changed that. It gave me structure and support when I needed it most.

Business has ups and downs, but RentSpace kept me consistent. I saved, they supported, my rent was paid on time.

Life after service wasn’t easy. But with RentSpace, I found a simple way to save and stay independent.

Saving for rent used to scare me. With RentSpace, I reached 70% and got help with the rest. I cried happy tears.